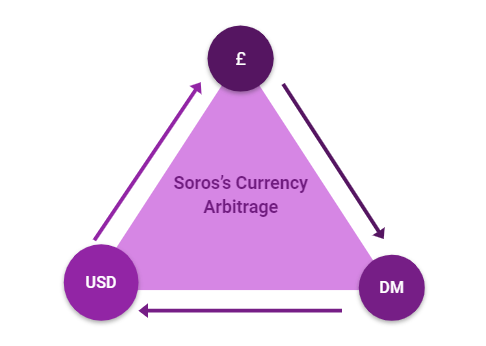

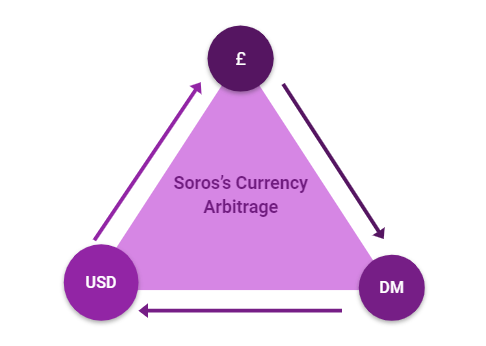

Triangular currency arbitrage is the successive exchange of three currencies when a discrepancy exists among them in a specific consecutive order by which sequential transactions and conversions occur facilitated in modernity by an automated computerized algorithm that detects for these arbitrage opportunities and exploits them with expedience and precision. A alternative example of triangular currency arbitrage is George Soro’s exploitation of Britain’s ERM (Exchange Rate Mechanism on September 16, 1992 infamously known as Black Wednesday. Soros noticed that the ERM enforced a fixed 2.7 Mark / Pound exchange rate despite the Pounds gross inflation which was fundamentally unstable and began borrowing pounds from banks. He then sold his Pounds for Marks that he continually held while repeating this process as it gained momentum at other funds and brokerage houses. Subsequently, the value of the pound plummeted against that of the Mark, and Soros bought back his originally borrowed Pounds at a fraction of the cost retaining a $1Bln profit or $15.00 for every British citizen in 1992 as estimated by the Wall Street Journal.

Triangular currency arbitrage is the successive exchange of three currencies when a discrepancy exists among them in a specific consecutive order by which sequential transactions and conversions occur facilitated in modernity by an automated computerized algorithm that detects for these arbitrage opportunities and exploits them with expedience and precision. A alternative example of triangular currency arbitrage is George Soro’s exploitation of Britain’s ERM (Exchange Rate Mechanism on September 16, 1992 infamously known as Black Wednesday. Soros noticed that the ERM enforced a fixed 2.7 Mark / Pound exchange rate despite the Pounds gross inflation which was fundamentally unstable and began borrowing pounds from banks. He then sold his Pounds for Marks that he continually held while repeating this process as it gained momentum at other funds and brokerage houses. Subsequently, the value of the pound plummeted against that of the Mark, and Soros bought back his originally borrowed Pounds at a fraction of the cost retaining a $1Bln profit or $15.00 for every British citizen in 1992 as estimated by the Wall Street Journal.Introduction to Fundamental Analysis and Intrinsic Valuation Methods, Algorithmic Trading, Derivatives, and Arbitrage

Triangular Currency Arbitrage

Triangular currency arbitrage is the successive exchange of three currencies when a discrepancy exists among them in a specific consecutive order by which sequential transactions and conversions occur facilitated in modernity by an automated computerized algorithm that detects for these arbitrage opportunities and exploits them with expedience and precision. A alternative example of triangular currency arbitrage is George Soro’s exploitation of Britain’s ERM (Exchange Rate Mechanism on September 16, 1992 infamously known as Black Wednesday. Soros noticed that the ERM enforced a fixed 2.7 Mark / Pound exchange rate despite the Pounds gross inflation which was fundamentally unstable and began borrowing pounds from banks. He then sold his Pounds for Marks that he continually held while repeating this process as it gained momentum at other funds and brokerage houses. Subsequently, the value of the pound plummeted against that of the Mark, and Soros bought back his originally borrowed Pounds at a fraction of the cost retaining a $1Bln profit or $15.00 for every British citizen in 1992 as estimated by the Wall Street Journal.

Triangular currency arbitrage is the successive exchange of three currencies when a discrepancy exists among them in a specific consecutive order by which sequential transactions and conversions occur facilitated in modernity by an automated computerized algorithm that detects for these arbitrage opportunities and exploits them with expedience and precision. A alternative example of triangular currency arbitrage is George Soro’s exploitation of Britain’s ERM (Exchange Rate Mechanism on September 16, 1992 infamously known as Black Wednesday. Soros noticed that the ERM enforced a fixed 2.7 Mark / Pound exchange rate despite the Pounds gross inflation which was fundamentally unstable and began borrowing pounds from banks. He then sold his Pounds for Marks that he continually held while repeating this process as it gained momentum at other funds and brokerage houses. Subsequently, the value of the pound plummeted against that of the Mark, and Soros bought back his originally borrowed Pounds at a fraction of the cost retaining a $1Bln profit or $15.00 for every British citizen in 1992 as estimated by the Wall Street Journal.

Subscribe to:

Comments (Atom)

SPACs: Risk Arbitrage with Special Purpose Acquisition Companies Long and IPOed Companies Short (2)

For a recap of what a SPAC is and how to exploit emerging risk arbitrage opportunities in SPACs and their subsequent IPOed companies, pleas...

-

Some may contend that Tesla is a disruptive sector innovative and altruistic force for good in terms of its environmental impact e...

-

Bill Ackman in his firm, Pershing Square's recent interim financial statement release to investors makes a rather unconventi...

-

The United States' solution to essentially every recession within the past few decades was and is presently to create new currency and r...

No comments:

Post a Comment