The stochastic discount factor, often abbreviated as (SDF) is a concept in mathematical finance whereby the discounting of future cashflows,![]() is by the stochastic factor,

is by the stochastic factor,![]() as opposed to the WACC of traditional DCF Valuation.

as opposed to the WACC of traditional DCF Valuation.

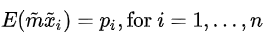

The following sequence is representative of the relationship between initial price inputs and payoff output values of and , respectively

implying

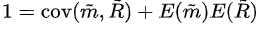

If the assets comprise a portfolio, then SDF rationalizes

The covariances standard identity presents

If a risk free asset, then signifies

Inserting this into the preceding equation produces the following formula for the risk of any portfolio or asset with the return

No comments:

Post a Comment