Introduction to Fundamental Analysis and Intrinsic Valuation Methods, Algorithmic Trading, Derivatives, and Arbitrage

Wednesday, August 19, 2020

Is TSLA a Cult Stock or Emergent Innovator

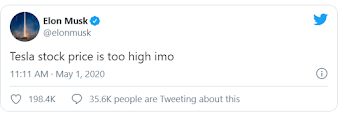

Some may contend that Tesla is a disruptive sector innovative and altruistic force for good in terms of its environmental impact extenuating its 536% annualized gain this year by referring to its immense revenue growth; nevertheless, scrutiny of its peculiar balance sheet and lack of profitability is not unwarranted. Its total sales and revenue growth during the second and third quarters of this year fail to justify its current valuation. Assuming a basic median price/sales ratio and a nominal discount rate, its valuation of $181.86 is far exceeded by its current share price of $425.68. Even Elon Musk, the company's founder himself admitted that the stock may be a bit inflated in an interview months ago preceding a subsequent 352% gain and stock split. This is what Vitaliy Katsenelson refers to in his book as a cult stock, a company that is so inconceivably overpriced its 'followers' or shareholders must justify it current price by other means, such as revenue or sales growth. Tesla comparable to FANG companies which were elaborated upon in a previous post, is so illogically overvalued, but followed and owned or 'worshipped' that it may not present an optimal potential short position. Famous short seller and hedge fund manager David Einhorn initiated a gargantuan short position in the company earlier this year that cost him $500 million of his net worth. It is obvious to short outrageously overpriced securities, but not fanatically followed cults.

Subscribe to:

Post Comments (Atom)

SPACs: Risk Arbitrage with Special Purpose Acquisition Companies Long and IPOed Companies Short (2)

For a recap of what a SPAC is and how to exploit emerging risk arbitrage opportunities in SPACs and their subsequent IPOed companies, pleas...

-

Some may contend that Tesla is a disruptive sector innovative and altruistic force for good in terms of its environmental impact e...

-

Bill Ackman in his firm, Pershing Square's recent interim financial statement release to investors makes a rather unconventi...

-

The United States' solution to essentially every recession within the past few decades was and is presently to create new currency and r...

No comments:

Post a Comment